Comprehensive Wealth Planning

The mosaic of wealth is multi-faceted and distinctive to each client.

Common planning questions that we address:

- How long will my savings last? Am I going to be okay?

- How much can I spend, so I won’t run out of money too soon?

- When should I take my CPP and OAS benefits?

- Which financial assets should I use first to create an income stream?

- Is my current savings rate going to be enough to accomplish my goals?

- How much can I pass on to my kids and/or charity?

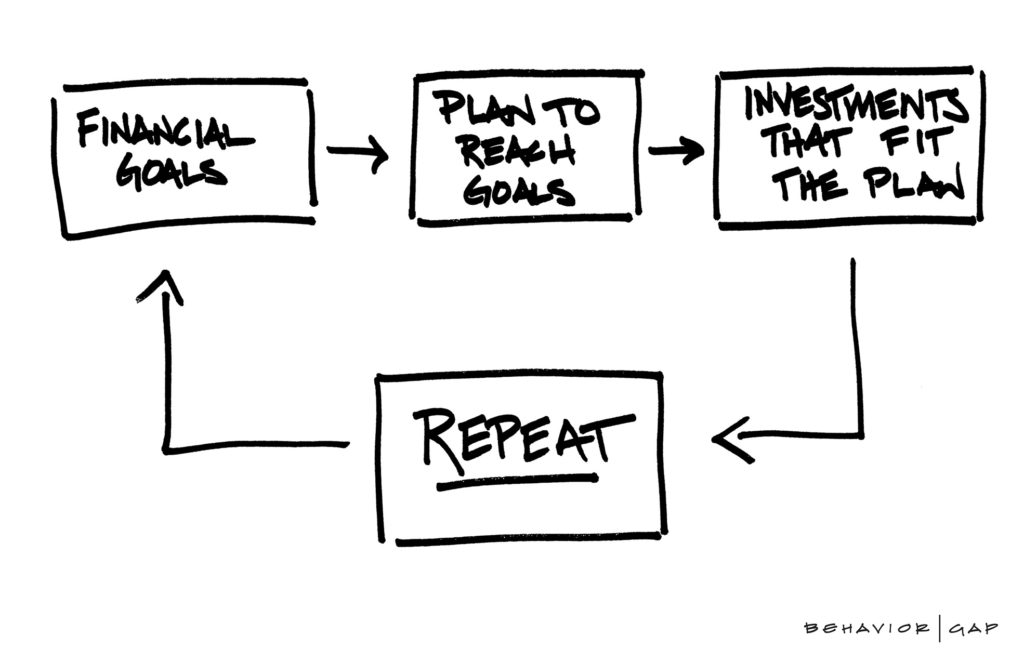

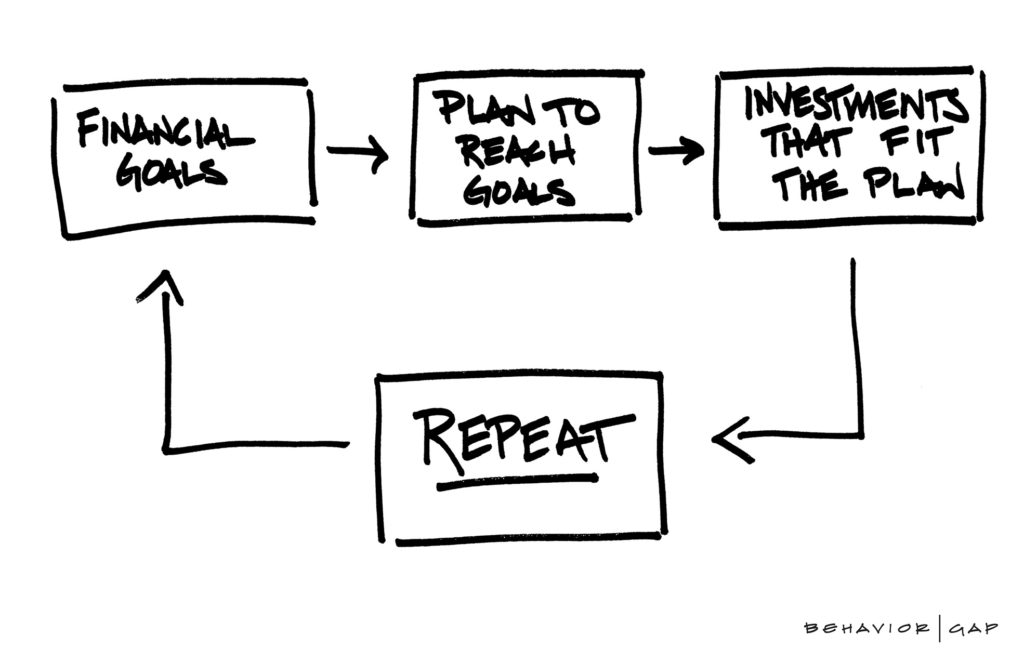

Our game plan to engage your questions:

- We listen, learn, and gather a complete picture of your circumstances.

- We strive to ask deliberate and specific questions to identify the full landscape under discussion.

- We develop and analyze each Wealth Plan to identify opportunities and issues.

- We engage the completed Wealth Plan and advise on strategic actions.

- We continually review, update, and refine as life unfolds.

Our Approach: Total Wealth Management.

Tax Management

- TFSA’s

- RRSP’s / RRIF’s

- Income Splitting

- Tax Loss Selling

- Tax analysis

- Capital Gains Exemption Planning

- Trust Planning

- Salary / Dividend Inocme Planning

Estate Planning

- Will Planning

- Powers of Attorney

- Inheritance

- Charitable and Legacy Planning

- Tax Efficient Transfer of Wealth

- Estate Preservation

- Probate Planning

Risk Management

- Insurance Needs Analysis

- Income Protection

- Asset Protection

- Estate Enhancement

- Life Insurance*

- Critical Illness / Disabilty*

- Buy/Sell, Key Person*

- Long Term Care*

Investment Strategy

- Risk Profile – Investment Policy Statement

- Portfolio Construction & Rebalancing

- Currency Hedging

- Multi-Manager Portfolio Solutions

- Responsible Investing – Environmental, Social and Governance

Family, Vision, & Goals

- What do you want to focus on right now?

- What are your visionary goals for the future?

- What are your biggest financial concerns?

- Communication of wealth priorities between generations

- Family meeting facilitation

*Insurance products and services are provided through Assante Estate and Insurance Services Inc.